Last week, the Maine Legislature voted to raise taxes on struggling Maine families and small businesses to pay for increased government spending. Rather than right-size unsustainable programs, most Democrat and some Republican legislators decided that state government still isn’t big enough. The tax hike to pay for the increased spending, including pay raises for thousands of state employees, is included in the two-year state budget that begins on July 1. The plan now heads to the desk of Governor Paul LePage for his consideration.

Two years ago, Maine state government started down a new and more promising path to help Maine families. Instead of encouraging more government dependency by expanding welfare and other programs, incentives are being put in place to attract business investment and more jobs. Maine families will enjoy better lives and brighter futures with the dignity and independence that come with a job. Of course, welfare safety nets must be maintained for the disabled, elderly sick, and those who cannot care for themselves. However, it’s not fair for government to lure able-bodied parents and their children to a lifetime of government programs and poverty.

Business owners risk expanding their operations and hiring more workers when they believe it will be profitable to do so. They look for lower taxes, fair and predictable regulations, less expensive energy and health insurance, well maintained roads-bridges-ports, and a prepared workforce. When companies grow, more workers have jobs and pay taxes. Those taxes fund essential government programs like public education, environmental protection, and public safety.

During the past 40 years, although well-intended, Augusta has not created an inviting business climate resulting in healthy job growth for Maine workers. We should be disheartened that 228,000 of our fellow Mainers depend on food stamps, the 6th highest percentage of households in the country. We should be concerned that 341,000 Mainers need Medicaid health care welfare services, the 3rd highest state enrollment rate. We should be alarmed that 20 percent of our senior citizens live in poverty, the 17th highest rate in the nation. We should also be saddened that too many young workers and their families are forced to leave the State they love for better jobs, or any jobs, elsewhere. Maine can do much better.

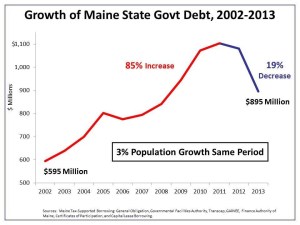

Maine should continue down our new path toward financial security and economic freedom created by attracting business investment and more jobs to our Great State. To that end, during the past two years, the dramatic growth of government spending has been halted and taxes have been lowered. Changes to our health insurance laws are beginning to drive down the cost of monthly premiums. Utility companies are starting to build natural gas pipelines that could lower monthly heating bills by 40%. Unnecessary and costly regulations have been repealed. For the first time, public charter schools are providing Maine students and their parents more educational choices. The graph below shows our shrinking public debt (and interest payments) over the past two years.

Each of these positive changes and many more are setting the cornerstones to attract business investment and jobs for hard-working Maine families. Like a rising tide, a growing economic pie will provide greater opportunities and lift all Mainers to a higher level of prosperity.

By reversing direction and raising taxes to pay for continued government overspending, the State Legislature will hurt Maine families in two ways. First, higher taxes will pull more money from the pockets of Maine citizens struggling to make ends meet during the deepest recession in 70 years.

Second, higher taxes will send exactly the wrong message to the business community: “If you start or expand your company in Maine, we will tax you and your employees more. We realize that our taxes are already among the highest in the nation, but we cannot control our appetite to overspend. Come to Maine so we can tax you more.” After considerable progress in starting to build a business-friendly climate, Maine will be viewed as not being serious about the initiative. This inconsistency will turn away business investment and jobs. In the end, Maine families will lose out.

There still might be time for our legislators to balance the two-year state budget without raising taxes on Maine families and small businesses. Let’s encourage them to have the courage to do what is right to help the hard-working people of Maine. Less government spending and lower taxes results in more jobs. That would be very good for Maine.

Bruce Poliquin is the former Maine State Treasurer and a 2012 Republican primary candidate for the United States Senate. He has 35 years of experience owning and managing businesses. Bruce is a proud third-generation Franco-American Mainer and Harvard University graduate. Visit BrucePoliquin.net for his most recent commentary and analysis on media outlets throughout the State about the important issues facing Maine families and their jobs. Follow Bruce on Facebook at www.facebook.com/BrucePoliquin and on Twitter at www.twitter.com/Brucepoliquin.

Comments are no longer available on this story